Our Services

We have recently completed the feasibility study and conceptualization for the business.

CURRENT STATUS

We have recently completed the feasibility study and conceptualization for the business. This includes the SWOT analysis (Strengths, Weaknesses, Opportunities and Threats) and studying the market needs and consumer trends. We have researched into and identified the available offerings in the market and are convinced that our product offerings can meet the needs of our target customers in the construction and engineering sectors.

We have developed our marketing and engineering details and tested our ideas through focus groups by asking a number of prospective customers on the product and services offerings that we will provide. We have identified and established tie-ups with components suppliers and contractors. At this moment, we believe that we have what it takes that can penetrate and serve the demand of the market segment that we are targeting.

OPERATIONS PLAN

SUPPLIERS AND SOURCING

Tunnelling and Underground infrastructure has become a world-wide trend solution to space scarcity, increase world population and urbanization. Particularly in Asia, underground infrastructure and tunnelling construction is fast becoming a priority in a rapidly-urbanizing Asia. With the numerous opportunities emerging in the booming and demanding Tunnelling and Underground space industry in Asia Singapore is a small city and a country, where prime land is scarce and there’s no room to sprawl.

Massive underground projects are going on today in cities around the world. Over the next two years, Beijing is adding 40 miles (64 kilometers) of subway lines to a system that already built 235 miles (378 kilometers) from 2007 to 2014. Helsinki recently opened a centralized wastewater treatment plant in an underground location, with a residential development set to be built on the ground above it. New York is finishing up a massive water tunnel that has been under construction since the 1970s. And Amsterdam is excavating an underground location for parking up to 7,000 bicycles.

TARGET MARKET AND SIZE

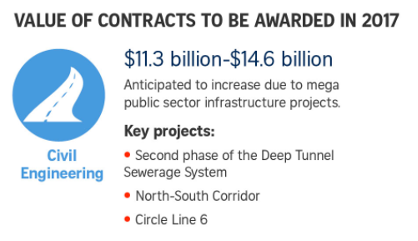

The construction sector had a rough year in 2016, but a surge in public sector building jobs should help the sector get its groove back from 2017. Public sector construction demand is projected to grow to between S$20 billion and S$24 billion this year, up from about S$15.8 billion in 2016, said the Building and Construction Authority (BCA). Public sector jobs this year include that of mega public sector infrastructure projects, such as various major contracts for the second phase of the Deep Tunnel Sewerage System, North-South Corridor and Circle Line 6.

BCA estimates that overall construction demand for 2018 and 2019 will be between S$26 billion and S$35 billion per annum, growing slightly to between S$26 billion and S$37 billion per annum in 2020 and 2021. Public sector demand over the next few years will include infrastructure projects such as the Jurong Regional Line, Cross Island Line and the development of Changi Airport Terminal 5. Singapore is now at a second phase of the rail addition. The rail network will be 360km long by 2030, which will bring it to a rail density similar to London and New York today. The overall on-site construction activities or construction output is expected to stay at a relatively high level in the years ahead. There is also a big push for companies to change, innovate and transform to stay at the forefront of technological innovation, process re-engineering and productivity improvement.

COMPETITORS

MARKET PLANS

GO TO MARKET AND PROMOTION STRATEGY

To gain traction for our new products, we aim to forge exclusive, long-term strategic partnerships with strategic partners identified include builders, engineering companies and consultancies. We hope that through our strategic partners, we will have a good rolling starting to launch the V.D.T Vulkan’s brand across the broader market. For our targeted customers, our promotional activity will be executed through both push and pull strategies.

The push strategy will call for the use of direct sales force and industrial marketing to introduce V.D.T Vulkan’s products to target customers. Personal selling will be necessary to reach decision makers within these organizations. To stimulate awareness among the industry, industrial marketing techniques will be utilized. This will involve running campaigns and presenting at trade fairs to reach decision makers

SALES CHANNELS AND DISTRIBUTION STRATEGY

PRODUCT PARTNERS

SYSTEM INTEGRATORS

OPERATIONS PLAN

SUPPLIERS AND SOURCING

TARGET MARKET AND SIZE

FINANCIAL PROJECTIONS

SALES FORECAST

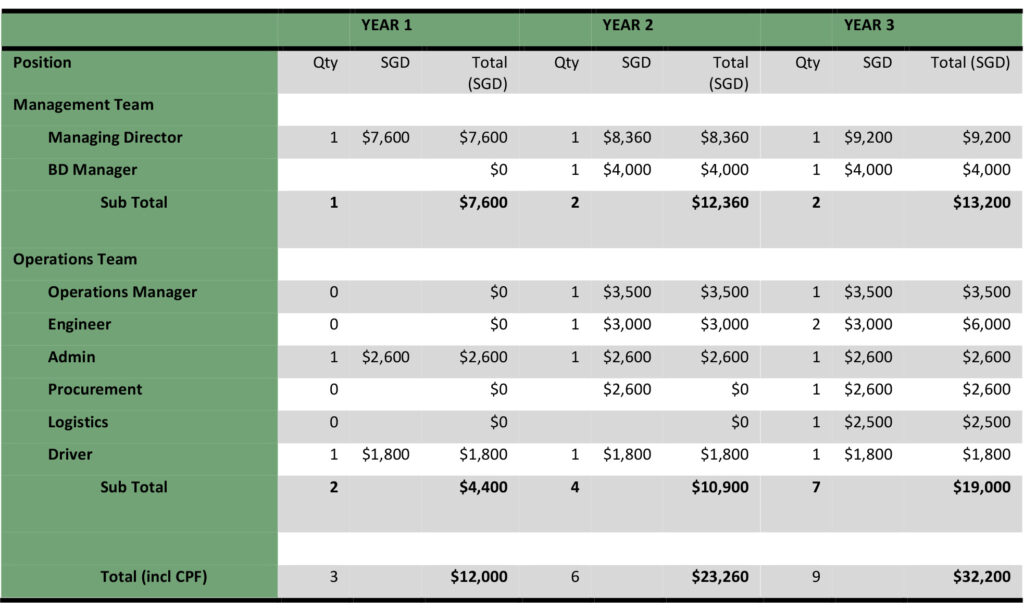

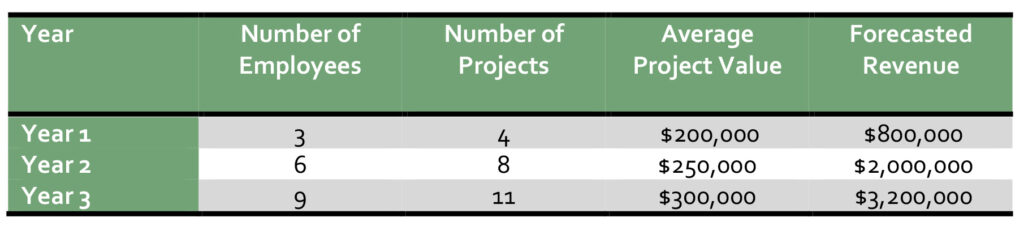

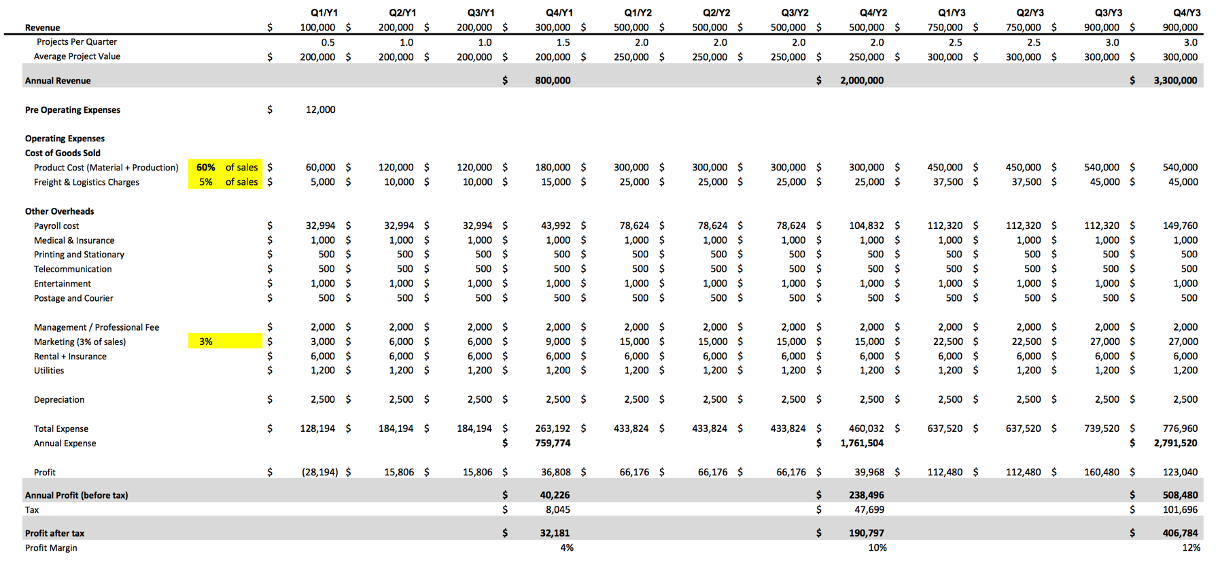

For the purpose of this business plan, we will stick to conservative forecast for the sales figures. We assume the growth in sales in the first 3 years to be as follow:

The first year will see V.D.T Vulkan ramping up and establishing client base and market share. The first year is forecasted to start off with sales of our products to support the 4 turnkey projects, with average sales revenue of S$200,000 per project. We target to achieve sales to support 6 projects in the second year and 9 projects in the third year, with average project value progressively increasing to S$300,000 as we take on bigger projects.

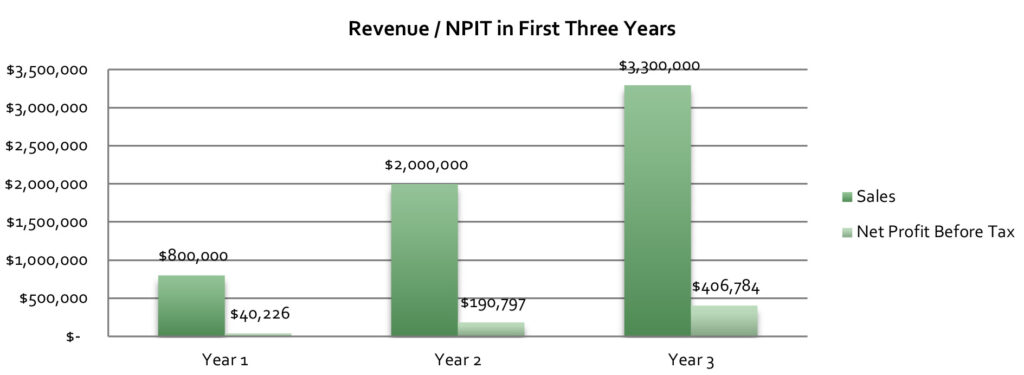

PROJECTED SALES AND NET PROFIT BEFORE TAX

Based on the financial projection modeled upon the earlier mentioned assumptions, we expect the business to reach operating breakeven by the first year of operations. Based on the projected sales and expenses (cost of goods sold, production and other overhead), the business is expected to yield profit margin after tax of about 17% once business stabilizes in the third year.

The table below illustrates the project Sales and Net Profit Before Tax for the first 3 years of operations. The basis for deriving the figures is tabulated in Appendix A: Financial Model.

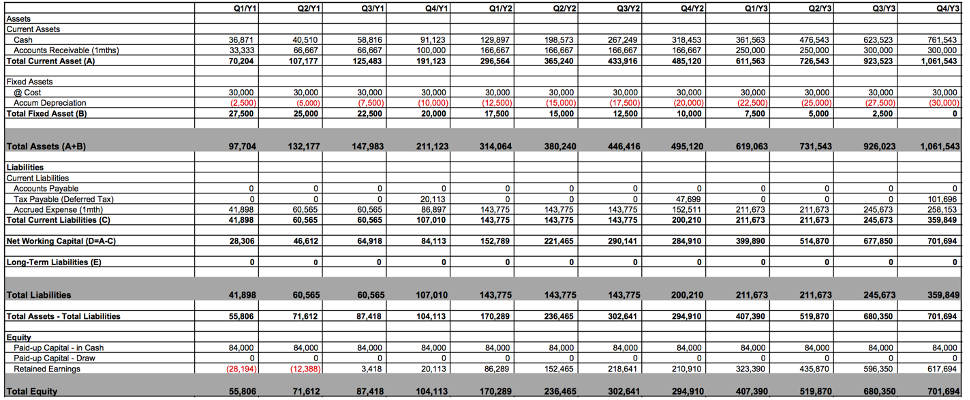

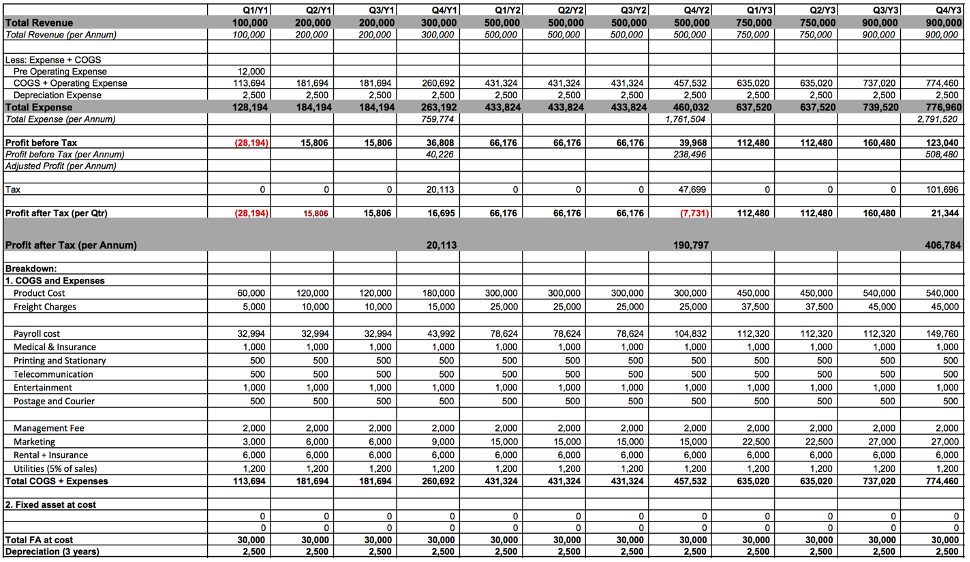

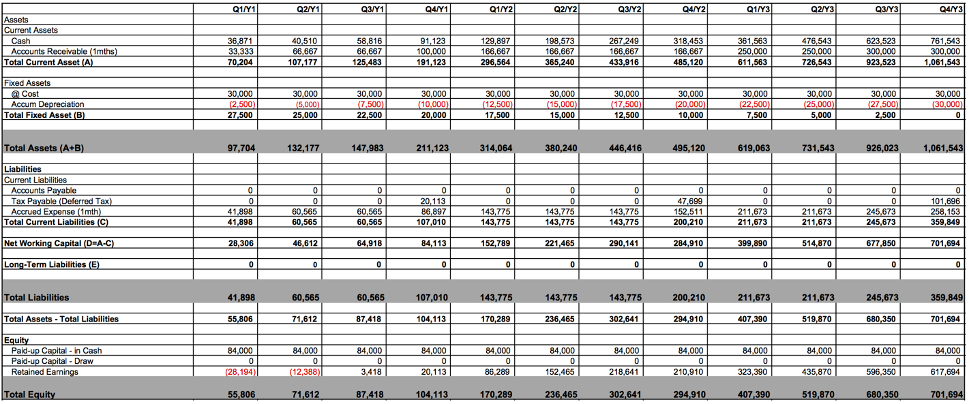

DETAILED PRO FORMA FINANCIAL STATEMENTS

The detailed pro-forma Balance Sheet, Income Statement and Cash Flow Statements of the first 3 years’ projection can be found in Appendix B.

APPENDIX A: FINANCIAL MODEL

IMPORTANT ASSUMPTIONS

- All dollars are in Singapore Dollars.

- Staffing

- Comprising of

- Managing Director (S$7,600 monthly)

- Admin (S$2,600 monthly)

- Driver (S$1,800 monthly)

- 1 month AWS bonus per annum

- Comprising of

- Fixed Assets

- Fixed Assets purchase of S$30,000

- Straight line depreciation over 3 years

- Pre-Operating Expenses

- Administration (S$3,000)

- Discussion and Tie Ups with Distributor (S$5,000)

- Rental Deposits (S$2,000)

- Cost of Goods Sold

- Product / Material Cost (60% of sales)

- Freights and Logistics (5% of sales)

- Rental of office and facility at S$2,000 per month

- Marketing (3% of sales)